Thinking about retirement as a teacher in Texas? Well, you're not alone. The Teacher Retirement System of Texas (TRS) is a vital part of every educator's journey, offering a safety net for the golden years. Whether you're just starting your career or nearing the finish line, understanding TRS can make all the difference. Let's dive into the nitty-gritty of this system and see how it can benefit you!

Retirement may seem like a distant dream when you're juggling lesson plans and parent-teacher conferences, but trust me, it sneaks up on you faster than you think. That’s why knowing the ins and outs of the Teacher Retirement System of Texas is crucial. From pension plans to healthcare benefits, TRS has got your back—but only if you know how to make the most of it.

This guide isn’t just another boring list of facts. It’s your go-to resource for everything TRS-related, packed with actionable tips, real-world examples, and insider insights. So, grab your favorite drink, sit back, and let’s explore the world of teacher retirement in Texas together!

Read also:Do You Cook Meat Before Dehydrating The Ultimate Guide To Mastering Meat Dehydration

What is the Teacher Retirement System of Texas?

The Teacher Retirement System of Texas, or TRS, is essentially a public retirement plan designed specifically for educators and employees of public schools and institutions in the Lone Star State. Think of it as a financial safety net that kicks in once you’ve hung up your teaching hat. It’s not just about pensions; TRS also offers healthcare benefits, disability options, and even survivor benefits.

Now, here’s the kicker: TRS isn’t some one-size-fits-all deal. There are different tiers, plans, and rules that can vary depending on when you started teaching and how long you’ve been contributing. For instance, if you started teaching before 2014, you might be part of Tier One, which comes with its own set of perks and requirements. But don’t worry—we’ll break it all down for you.

Eligibility Criteria for TRS

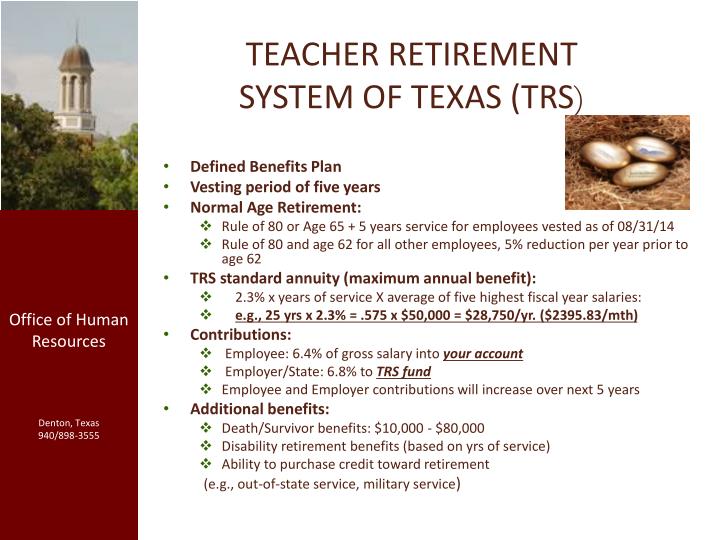

Not everyone gets to jump on the TRS bandwagon right away. To qualify, you typically need to meet certain eligibility criteria. First off, you must be employed by a participating public school or institution in Texas. Second, you need to contribute a specific percentage of your salary to the system. Currently, that’s around 7.7%, but hey, rules can change, so it’s always good to double-check.

Here’s a quick rundown of the basic eligibility requirements:

- Employment with a TRS-participating entity.

- Contributions of at least 7.7% of your salary.

- Completion of the required service years for retirement benefits.

Service Years and Vesting Periods

One of the most important things to understand is the concept of service years and vesting periods. In simple terms, you need to put in a certain number of years of service to become fully vested in the TRS system. For most educators, that magic number is five years. Once you hit that milestone, you’re officially vested, meaning your benefits are locked in even if you leave your teaching job.

But here’s the thing: being vested doesn’t automatically mean you can retire. You still need to meet the age and service requirements to start collecting your pension. For example, under Tier One, you might be eligible to retire at age 62 with at least five years of service. Or, if you’re feeling adventurous, you can opt for an early retirement option—but more on that later.

Read also:Newport News Real Estate Assessments Your Ultimate Guide To Property Value

Understanding TRS Pension Plans

Pensions are the bread and butter of the TRS system. They provide a steady stream of income during your retirement years, helping you maintain your lifestyle without having to dip into your savings. But how exactly do these pensions work? Let’s break it down.

Your pension amount is calculated based on a few key factors: your final average salary (FAS), your years of service, and the TRS multiplier. The FAS is typically the average of your highest three consecutive years of salary. Multiply that by your years of service and the TRS multiplier (currently around 2.3%), and voila—you’ve got your estimated monthly pension payment.

TRS Tier One vs. Tier Two

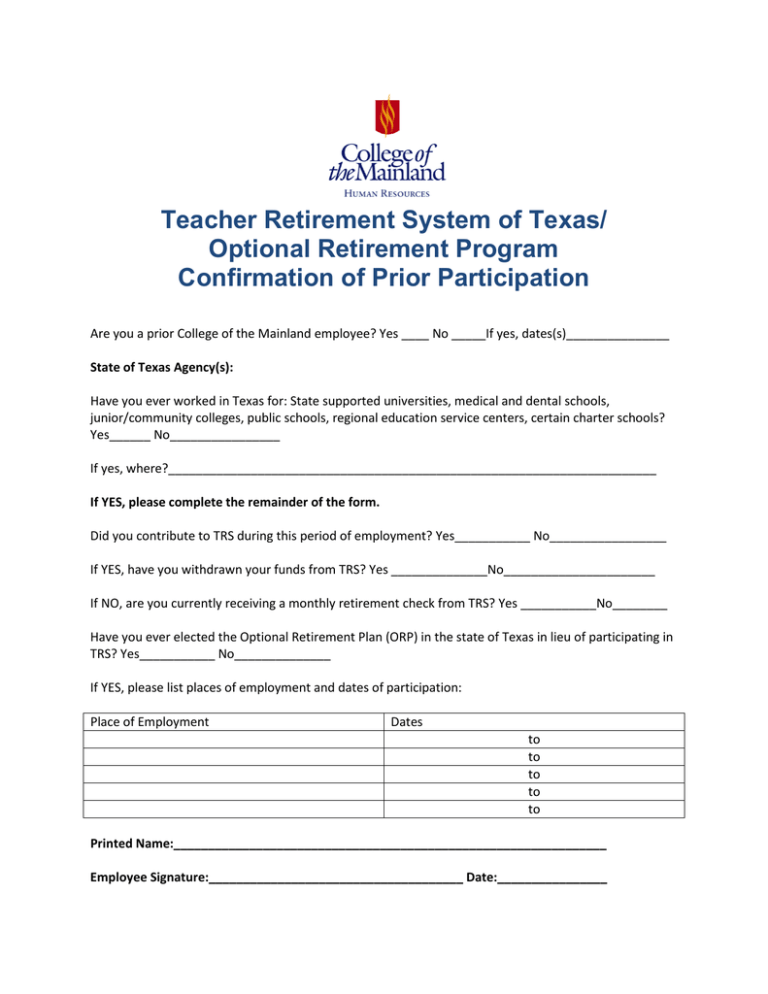

As I mentioned earlier, TRS has different tiers, and the one you belong to can affect your benefits. Tier One is for those who started teaching before September 1, 2014, while Tier Two is for new hires after that date. While both tiers offer pensions, there are some key differences:

- Tier One: Generally offers higher benefits and more flexibility with retirement options.

- Tier Two: Has slightly lower multipliers but includes a mandatory 401(k)-style plan called the Optional Retirement Program (ORP).

It’s worth noting that if you’re in Tier Two, you’ll need to decide whether to stick with the traditional pension or opt for the ORP, which gives you more control over your investments but less guaranteed income in retirement.

Healthcare Benefits through TRS

Retirement isn’t just about money; it’s also about staying healthy. That’s where TRS-Care comes in. TRS-Care is the healthcare component of the Teacher Retirement System, offering affordable health insurance options for retired educators and their dependents. You can choose from a variety of plans, including HMOs, PPOs, and even Medicare supplement plans.

One of the coolest things about TRS-Care is that it’s subsidized by the state of Texas, meaning you pay less out-of-pocket compared to private insurance plans. Plus, if you’ve worked at least 15 years in a TRS-participating entity, you’re eligible for premium reductions, which can save you a ton of money in the long run.

Medicare Integration with TRS-Care

If you’re retiring at or after age 65, you’ll likely be eligible for Medicare. TRS-Care can integrate with Medicare to provide additional coverage, filling in the gaps that Medicare doesn’t cover. This can include things like prescription drugs, dental care, and vision services. It’s like having the best of both worlds!

Investing in Your Future with TRS

While pensions are great, they’re not the only way TRS helps you save for retirement. The system also offers investment opportunities through programs like the Optional Retirement Program (ORP) and the Tax-Deferred Annuity (TDA) plan. These programs allow you to contribute pre-tax dollars to investment accounts, giving your savings a chance to grow over time.

Here’s a quick look at what these programs entail:

- Optional Retirement Program (ORP): Available to Tier Two members, the ORP lets you invest in a 401(k)-style plan with various investment options. It’s a great choice if you prefer more control over your retirement funds.

- Tax-Deferred Annuity (TDA): Open to all TRS members, the TDA allows you to contribute additional money to a tax-deferred account, offering even more opportunities for growth.

Maximizing Your TRS Contributions

Whether you’re contributing to the traditional pension plan, the ORP, or the TDA, it’s important to make the most of your contributions. Here are a few tips to help you maximize your TRS investments:

- Start contributing early to take advantage of compound interest.

- Diversify your investments to spread out risk.

- Regularly review your portfolio and make adjustments as needed.

Retirement Planning Tips for Texas Educators

Retirement planning isn’t something you can just set and forget. It requires ongoing attention and adjustments to ensure you’re on track to meet your goals. Here are some practical tips to help you plan for a secure and comfortable retirement:

First, create a retirement budget. This will give you a clear picture of how much money you’ll need to live comfortably in your golden years. Next, consider working with a financial advisor who specializes in TRS to help you navigate the complexities of the system. They can provide personalized advice and strategies to maximize your benefits.

Finally, stay informed about changes to the TRS system. Laws and regulations can evolve over time, so it’s important to stay up-to-date with the latest developments. Subscribing to TRS newsletters or attending retirement seminars can be a great way to stay in the loop.

Common Mistakes to Avoid

Even the best-laid plans can go awry if you’re not careful. Here are some common mistakes to avoid when planning for retirement with TRS:

- Underestimating your retirement needs.

- Not contributing enough to your pension or investment accounts.

- Ignoring healthcare costs in your retirement planning.

Real-Life Success Stories

Sometimes, hearing about real people’s experiences can be the best motivation. Let me share a couple of success stories from Texas educators who’ve made the most of the TRS system:

Take Sarah, a high school teacher from Austin who started contributing to TRS early in her career. By the time she retired at 65, she had accumulated a substantial pension and a well-diversified investment portfolio. Her careful planning allowed her to travel the world and pursue her passion for photography in retirement.

Then there’s Mark, a middle school principal who opted for the ORP and took an active role in managing his investments. Thanks to his savvy investment choices, he was able to retire early and start his own consulting business, all while maintaining his TRS healthcare benefits.

Lessons Learned from Success Stories

What can we learn from these stories? First, starting early and staying consistent with your contributions can pay off big time. Second, taking an active role in managing your investments can lead to greater returns. And finally, don’t be afraid to explore alternative retirement options like the ORP if they align with your goals.

Conclusion: Securing Your Future with TRS

In conclusion, the Teacher Retirement System of Texas is a powerful tool for educators looking to secure their financial future. From pensions to healthcare benefits, TRS offers a wide range of options to help you prepare for a comfortable and fulfilling retirement. By understanding the system, contributing regularly, and planning ahead, you can set yourself up for success.

So, what’s the next step? If you haven’t already, start by reviewing your TRS account to see where you stand. Then, consider meeting with a financial advisor to create a personalized retirement plan. And don’t forget to stay informed about TRS updates and changes that could affect your benefits.

Remember, retirement isn’t just about numbers—it’s about living the life you’ve always dreamed of. With TRS on your side, that dream can become a reality. So, take action today and start building the retirement you deserve!

Table of Contents