When it comes to investing, having a diversified fund portfolio is like having a Swiss Army knife for your financial future. It’s not just about throwing money into random stocks or bonds—it’s about creating a balanced, risk-managed strategy that works for you. Imagine this: you’re building a financial fortress that can withstand market storms while still capturing growth opportunities. Sounds pretty cool, right? But what exactly is a diversified fund portfolio, and why should you care? Let’s dive in.

Investing can feel overwhelming, especially if you’re new to the game. You’ve probably heard the phrase "don’t put all your eggs in one basket." Well, a diversified fund portfolio takes that advice to the next level. It’s about spreading your investments across different asset classes, sectors, and geographies to reduce risk and maximize returns. Think of it as a well-rounded team where each player has a unique role to play.

Whether you’re a seasoned investor or just starting out, understanding how a diversified fund portfolio works can transform your financial journey. In this article, we’ll break it down for you—what it is, why it matters, and how you can build one that aligns with your goals. So grab a coffee, get comfy, and let’s explore the world of diversified fund portfolios together!

Read also:Football Quotes For Kids Inspiring The Next Generation On And Off The Field

What is a Diversified Fund Portfolio?

A diversified fund portfolio is essentially a collection of investments that spans various asset classes, sectors, and geographic regions. Instead of putting all your money into one type of investment, like stocks or real estate, you spread it out to create a balanced mix. This approach helps mitigate risks because if one investment underperforms, others might offset the losses.

For example, if you have a portfolio with both stocks and bonds, a downturn in the stock market won’t necessarily sink your entire portfolio. Bonds tend to be more stable, so they can act as a safety net during volatile times. Diversification isn’t just about quantity—it’s about quality and variety. You want to ensure that your portfolio reflects a mix of assets that complement each other.

Key Components of a Diversified Fund Portfolio

Building a diversified fund portfolio involves more than just picking random investments. Here are some key components to consider:

- Stocks: These represent ownership in companies and offer potential for high returns but come with higher risks.

- Bonds: These are debt investments where you lend money to entities like governments or corporations in exchange for interest payments.

- Real Estate: Investing in property can provide rental income and appreciation over time.

- Commodities: Assets like gold, oil, and agricultural products can add diversity and act as a hedge against inflation.

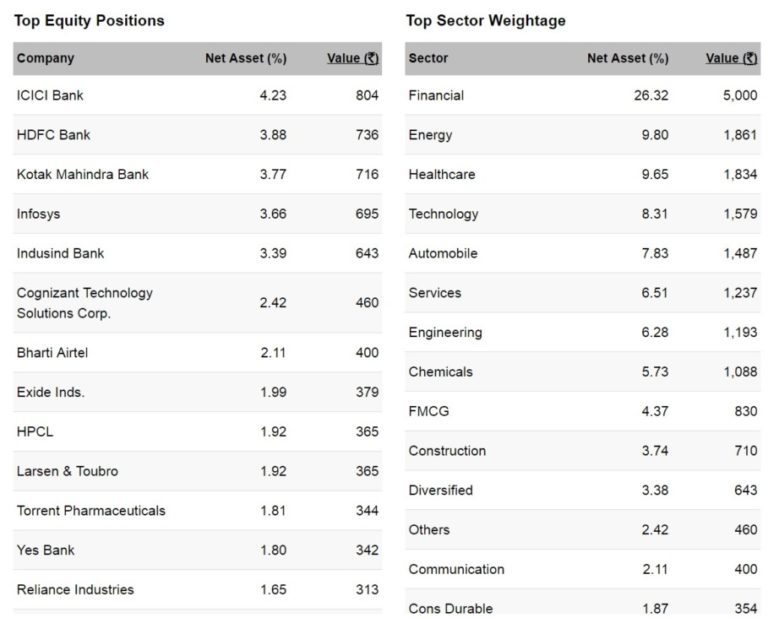

- International Investments: Including assets from different countries can protect your portfolio from local economic downturns.

Each of these components plays a crucial role in balancing risk and reward. By combining them thoughtfully, you can create a portfolio that aligns with your financial goals and risk tolerance.

Why Does Diversification Matter?

Diversification is like insurance for your investments. It helps protect your portfolio from market fluctuations and unexpected events. Think about it—no one can predict the future. Markets can be unpredictable, and economic conditions can change rapidly. A diversified fund portfolio acts as a buffer, ensuring that your financial well-being isn’t tied to the success of a single investment.

Additionally, diversification can enhance returns over the long term. By investing in a mix of assets, you increase your chances of capturing growth opportunities across different sectors and regions. For instance, while tech stocks might be booming today, tomorrow it could be renewable energy or healthcare. A diversified portfolio allows you to participate in multiple growth stories without betting everything on one trend.

Read also:Why A Firearm Background Check Delayed In Texas Can Be A Real Headscratcher

Risk Management Through Diversification

Risk is an inherent part of investing, but diversification helps manage it effectively. Here’s how:

- Reduced Volatility: A well-diversified portfolio tends to experience less extreme ups and downs compared to a concentrated one.

- Hedging Against Losses: If one asset class underperforms, others may perform better, offsetting potential losses.

- Improved Long-Term Returns: Diversification can lead to more consistent returns over time, helping you achieve your financial goals.

Remember, diversification doesn’t eliminate risk entirely, but it significantly reduces it. It’s like wearing a helmet when riding a bike—it won’t prevent accidents, but it’ll protect you if one happens.

How to Build a Diversified Fund Portfolio

Building a diversified fund portfolio requires careful planning and consideration of your financial goals, risk tolerance, and time horizon. Here’s a step-by-step guide to help you get started:

Step 1: Define Your Financial Goals

Before diving into investments, take a moment to clarify what you want to achieve. Are you saving for retirement, buying a house, or funding your child’s education? Your goals will influence the types of investments you choose and the level of risk you’re willing to take.

Step 2: Assess Your Risk Tolerance

Understanding how much risk you’re comfortable with is crucial. Some people thrive on high-risk, high-reward investments, while others prefer stability. Be honest with yourself about your risk tolerance—it’ll guide your investment decisions.

Step 3: Allocate Assets Wisely

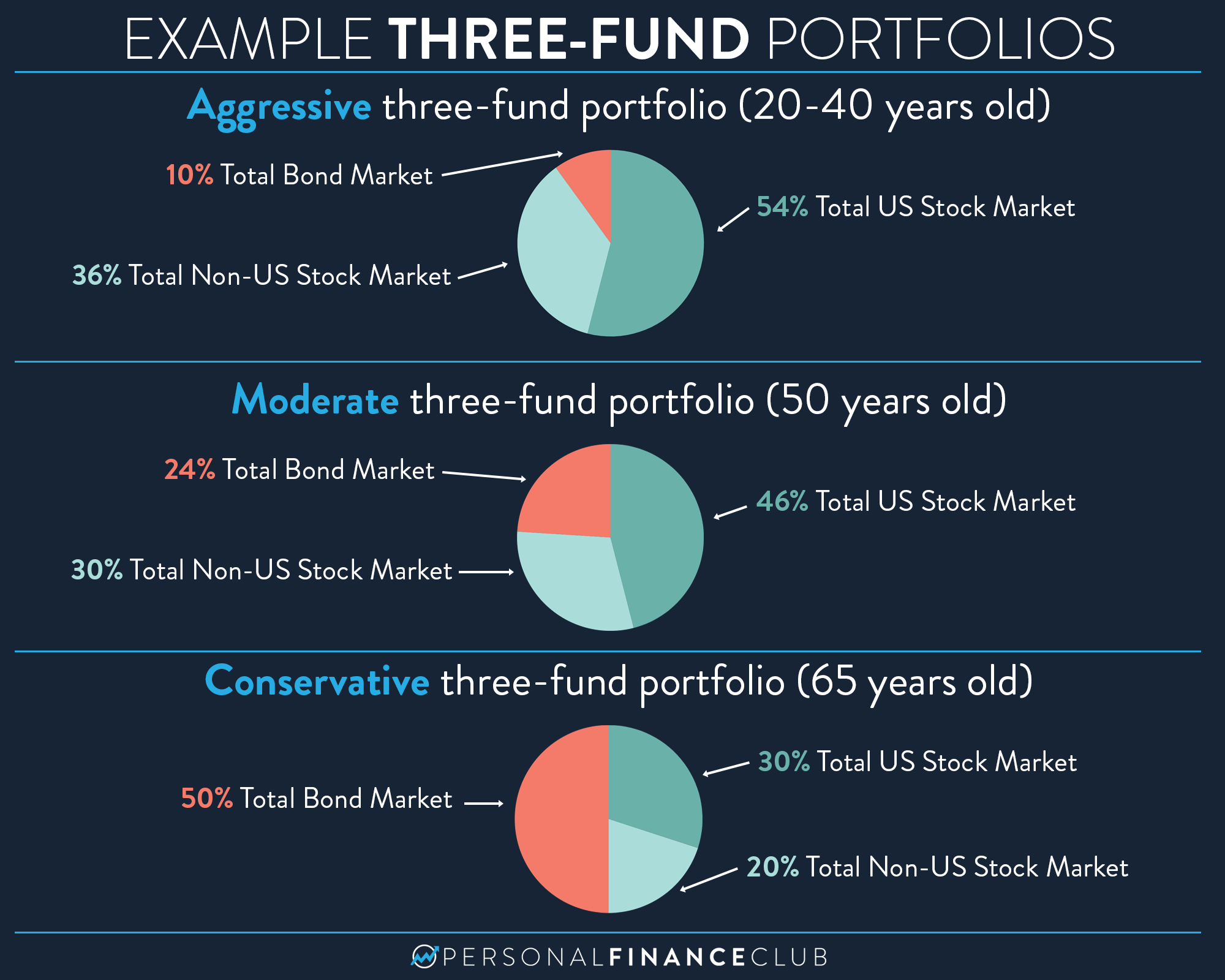

Asset allocation is the process of dividing your investments among different asset classes. A common rule of thumb is the "100 minus your age" rule, which suggests allocating a percentage of your portfolio to stocks equal to 100 minus your age. For example, if you’re 30, you might put 70% in stocks and the rest in bonds or other assets. However, this is just a guideline—your specific allocation should reflect your unique circumstances.

Step 4: Choose Quality Investments

Not all investments are created equal. When selecting funds or individual securities, look for those with strong track records, low fees, and alignment with your goals. Consider factors like expense ratios, management teams, and historical performance.

Step 5: Regularly Review and Rebalance

Markets change, and so might your financial situation. Regularly reviewing your portfolio ensures it stays aligned with your goals. Rebalancing involves adjusting your asset allocation to maintain the desired balance. For example, if stocks have outperformed and now make up a larger portion of your portfolio than intended, you might sell some and reinvest in bonds to restore balance.

Common Misconceptions About Diversified Fund Portfolios

There are several myths surrounding diversified fund portfolios that can lead to poor investment decisions. Let’s debunk some of them:

Myth 1: More Investments Mean Better Diversification

Having a large number of investments doesn’t automatically mean you’re diversified. Quality matters more than quantity. A portfolio filled with similar assets or overlapping funds won’t provide true diversification.

Myth 2: Diversification Guarantees Profits

While diversification reduces risk, it doesn’t guarantee profits. Markets can still decline, and losses can occur. However, diversification helps smooth out the ride and increases the likelihood of long-term success.

Myth 3: Diversification is Only for Beginners

Diversification is beneficial for investors at all levels. Even seasoned professionals benefit from spreading their investments to manage risk and capture opportunities.

Benefits of a Diversified Fund Portfolio

Now that we’ve covered the basics, let’s explore the benefits of having a diversified fund portfolio:

- Reduced Risk: By spreading investments across asset classes, sectors, and regions, you minimize exposure to any single risk.

- Enhanced Returns: Diversification allows you to participate in multiple growth stories, potentially boosting your overall returns.

- Peace of Mind: Knowing your portfolio is well-diversified can give you confidence during market turbulence.

- Flexibility: A diversified portfolio can adapt to changing market conditions and economic environments.

These benefits make diversification an essential strategy for anyone serious about building wealth over the long term.

Challenges of Diversified Fund Portfolios

While diversification offers many advantages, it’s not without challenges. Here are a few to consider:

Challenge 1: Complexity

Building and managing a diversified portfolio can be complex, especially for beginners. It requires research, analysis, and ongoing monitoring. If you’re unsure where to start, consider consulting a financial advisor.

Challenge 2: Costs

Diversification can involve higher costs, such as transaction fees and management expenses. However, these costs are often outweighed by the benefits of reduced risk and enhanced returns.

Challenge 3: Dilution of Returns

While diversification reduces risk, it can also dilute potential returns. If one asset class performs exceptionally well, having too much invested elsewhere might limit your overall gains. However, this trade-off is usually worth it for long-term stability.

Tools and Resources for Building a Diversified Fund Portfolio

Thankfully, there are plenty of tools and resources available to help you build a diversified fund portfolio. Here are a few to consider:

- Robo-Advisors: These automated platforms use algorithms to create and manage diversified portfolios based on your goals and risk tolerance.

- Mutual Funds and ETFs: These investment vehicles offer instant diversification by pooling money from multiple investors to purchase a wide range of assets.

- Financial Advisors: If you prefer personalized guidance, a certified financial advisor can help design a portfolio tailored to your needs.

Using these tools can simplify the process and ensure your portfolio remains diversified and aligned with your objectives.

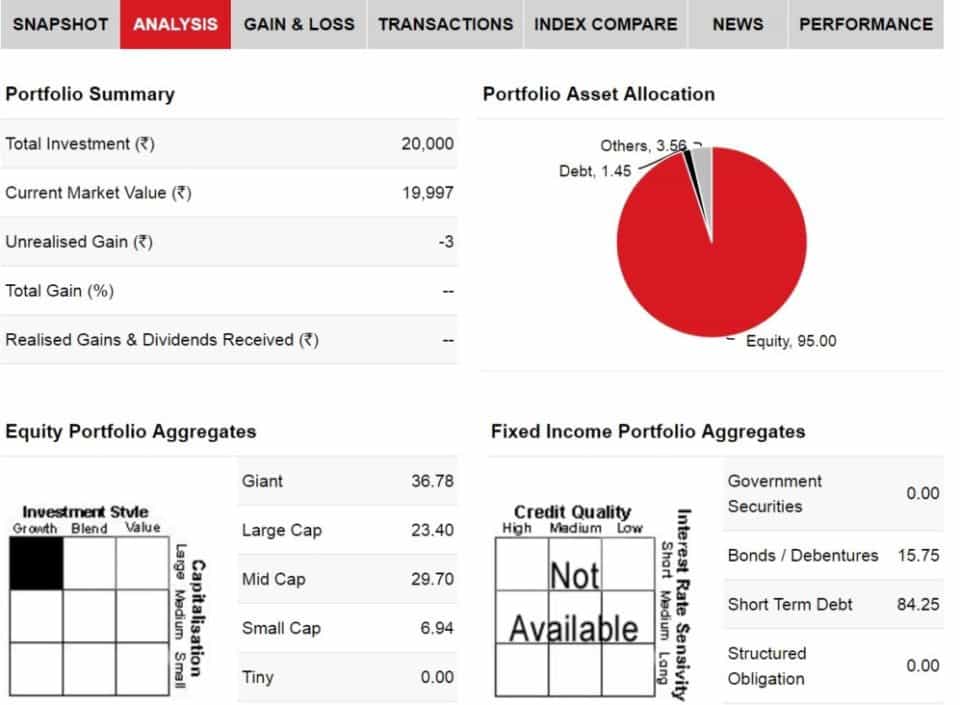

Real-Life Examples of Diversified Fund Portfolios

To see diversification in action, let’s look at a couple of real-life examples:

Example 1: John’s Retirement Portfolio

John is 50 years old and planning for retirement. His portfolio consists of 60% stocks, 30% bonds, and 10% real estate. This allocation reflects his moderate risk tolerance and long-term goals. He regularly reviews his portfolio and rebalances as needed.

Example 2: Sarah’s Growth Portfolio

Sarah is 35 and focused on growing her wealth. Her portfolio is heavily weighted toward stocks, with 80% allocated to domestic and international equities. The remaining 20% is split between bonds and commodities. Sarah is comfortable with higher risk in pursuit of greater returns.

These examples illustrate how diversification can be tailored to individual circumstances and goals.

Conclusion: Take Action Today

A diversified fund portfolio is a powerful tool for managing risk and achieving financial success. By spreading your investments across asset classes, sectors, and geographies, you create a balanced strategy that can weather market storms and capture growth opportunities. Remember, diversification isn’t a one-time event—it’s an ongoing process that requires attention and adjustment.

So, what’s next? Start by defining your financial goals and assessing your risk tolerance. Then, allocate your assets wisely and choose quality investments. Don’t forget to regularly review and rebalance your portfolio to stay on track. And if you need help, don’t hesitate to consult a financial advisor.

Now it’s your turn. Are you ready to build a diversified fund portfolio that aligns with your dreams? Share your thoughts in the comments below, and don’t forget to check out our other articles for more investment insights. Your financial future is waiting—go grab it!

Table of Contents

- What is a Diversified Fund Portfolio?

- Why Does Diversification Matter?

- How to Build a Diversified Fund Portfolio

- Common Misconceptions About Diversified Fund Portfolios

- Benefits of a Diversified Fund Portfolio

- Challenges of Diversified Fund Portfolios

- Tools and Resources for Building a Diversified Fund Portfolio

- Real-Life Examples of Diversified Fund Portfolios

- Conclusion: Take Action Today